As the name says, the Inverted Hammer Candlestick Pattern Forex Trading Strategy is based on the inverted hammer pattern.

Now, if you don’t know what a forex inverted hammer pattern looks like, don’t stress out, as I will explain here.

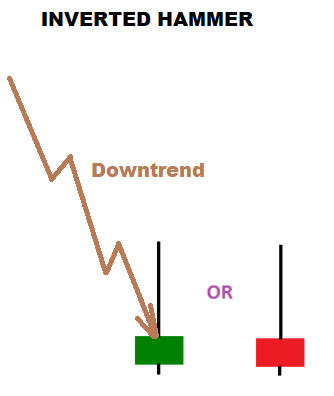

Inverted Hammer Candlestick Pattern

The inverted hammer candlestick pattern is a bullish chart reversal. This one-candlestick pattern looks like a shooting star candlestick pattern, but. In contrast, the shooting star candlestick pattern appears in an uptrend; the inverted hammer candlestick pattern forms in a downtrend.

Bullish Or Bearish?

- The inverted hammer pattern itself is bullish,

- But the candlesticks that classify as an inverted hammer can be both bullish or bearish candlestick patterns, as you can see below.

What Causes Inverted Hammer Pattern To Form?

In an inverted hammer pattern:

- The buyers overcame the sellers and pushed the price higher during that time.

- However, the chart price retraces and closes near the candle opening price.

- The buyers push high, and subsequent retracement by sellers is reflected by the very long upper wick or shadow.

- The fact that the price closes near the opening gives a very short body chart candlestick.

Inverted Hammer Pattern Forex Trading Strategy Buy Trading Rules

Since this is a bullish chart candlestick pattern, it only has buying rules.

Here are the rules:

- identify on your charts the possible chart price reversal points like support levels or resistance-turned-support levels, Fibonacci retracement levels, rising trendlines, etc

- When you see an inverted hammer chart pattern form, place a pending buy stop order 1-2 pips above the high of the invert hammer candlestick.

- Place your stop loss anywhere from 2-9 pips below the low of the inverted hammer candlestick pattern.

- For take profit target(TP), look for the nearest swing high and see if the risk: reward is quite good, like 1:3 or more and use them as your take profit(TP) target level.

Advantages Of Inverted Hammer Pattern Forex Trading Strategy

- Sometimes, you can pick the bottoms of the market accurately and ride out the upward trend for maximum profits when the pattern works out as anticipated.

- Reasonable risk: reward ratio

- If the daily chart is used, it can be a set and forget type of trading system.

Disadvantages Of Inverted Hammer Pattern Forex Trading Strategy

- As with any forex trading system, this also will have periods where the strategy signals will not work out as anticipated.

- There’s always the chance to think that the inverted hammer chart candlestick may be a shooting star, and traders miss the obvious by the signal being presented right in front of their face.

Read More: Piercing Line Pattern Forex Trading Strategy

[…] Read More: Inverted Hammer Candlestick Pattern Forex Trading Strategy […]

[…] Read More: Inverted Hammer Candlestick Pattern Forex Trading Strategy […]

[…] Read More: Inverted Hammer Candlestick Pattern Forex Trading Strategy […]

[…] you are a new forex trader, trying to identify candlestick patterns like forex reversal candlestick patterns and even pin bars can be difficult at first, so indicators like this pin bar detector are handy […]

[…] the Ultimate Candlestick Reversal Pattern forex indicator and its template loaded on forex […]

[…] Read More Inverted Hammer Candlestick Pattern Forex Trading Strategy […]