The ultimate Candlestick Reversal Pattern indicator consists of two last candles on charts with different directions where one is buying, the other is selling, and vice versa. The end of one signifies the start of the other one. A signal is confirmed when the last candle is closed, while it’s beginning on the end of the previous candle.

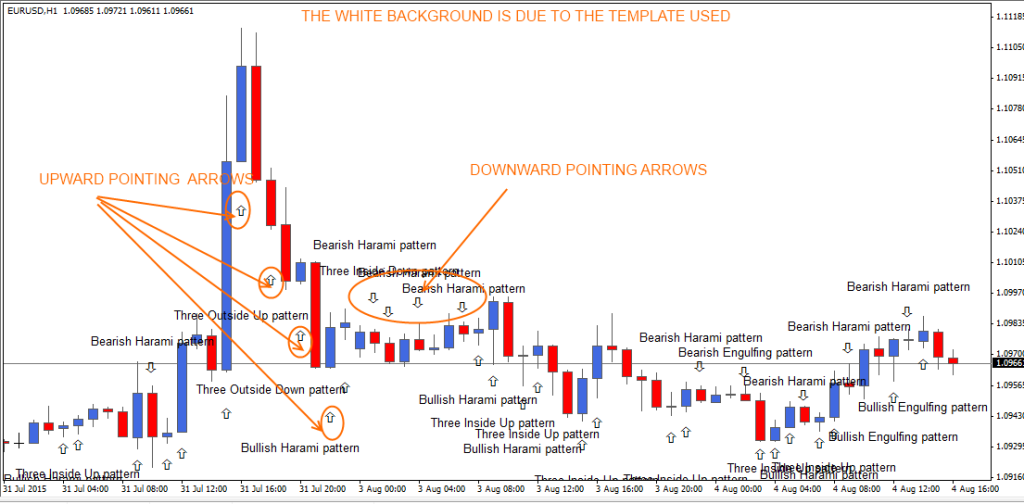

Fig. the Ultimate Candlestick Reversal Pattern forex indicator and its template loaded on forex MT4.

This forex indicator is one of its kind since it comes with its template. The template has no unique objects attached to it. Still, it is just a chart with a good background color for the default indicator settings associated with the Ultimate Candlestick Reversal Pattern indicator to be visible. So when you download the indicator file, you should load the template before loading the other indicators that come with the file.

What is a good time for using the Ultimate Candlestick Reversal Pattern?

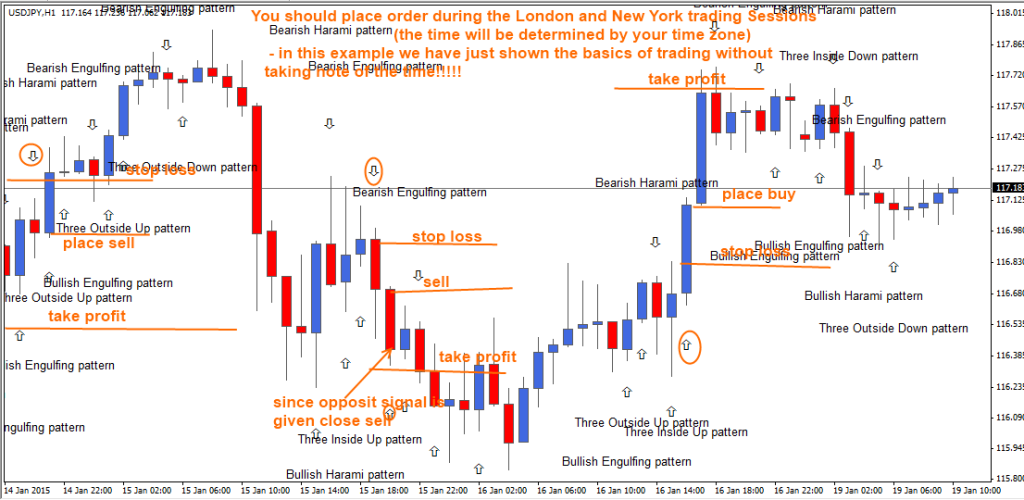

The best answer to this concern is in London and New York sessions. However, the forex trader should ignore (should not use this indicator to trade) the beginning of the London session and the end of the New York session because these are the instants in which little the exciting things occur, and there is a likelihood for you to get fake entry signals. Nevertheless, it’s up to the forex trader to make a strategy on which to make trades every time you see the entry signal or just during the London and New York session. But the good time is to stick to London and New York forex market sessions.

Placing trades using the Forex Ultimate Candlestick Reversal Pattern

While using this forex indicator, the trader should place buy orders when upward-pointing arrows are formed. On the other hand, the sell orders should be set when the downward pointing arrows are formed.

After placing each trade, the trader should stop losses and take profits(TP). However, if none of the stops(SL) is hit and an opposite signal is produced, the trader should close the open order.

Example:

Stop Loss and Take Profit

First, open positions should be opened by the closure of the second candle in the pattern to get a confirmation of whether the signal is correct.

Stop-loss(SL) should span between 40 and 70 pips, maybe even less if you know what you’re doing. With a lot of different forex strategies and trading systems over time, it has been proved that stop-losses of 40-60 pips are the best intraday short trades. When using forex Candlestick Reversal Pattern in combination with this type of stop, you’ll have about ninety-five percent of wins in your trades.

The forex trader should set up two take profits(TP): the first should be at +/- 20 pips, while the second entry one at +/- 50 pips. The first take profit(TP) is used to close most of the opened positions while about thirty percent of the positions are leſt, hoping that the price will reach +50 pips of profit.

Forex Ultimate Candlestick Reversal Pattern Indicator Free Download