The MultiHedge Robot is an advanced advisor designed to leverage the power of correlation strategies and hedging techniques to execute trades effectively. This article delves into the features, benefits, and potential limitations of the MultiHedge Robot.

The Multi Hedge EA focuses on three major currency pairs: USDCAD, USDJPY, and AUDUSD. It capitalizes on the correlations between these pairs to identify potential trading opportunities. The EA aims to exploit profitable trading conditions while minimizing risk exposure by analyzing the historical relationships and patterns between currency pairs.

Correlation Strategy

The foundation of the MultiHedge Robot lies in its correlation strategy. It meticulously examines the relationships between the selected currency pairs to identify moments of synchronicity or divergence. The EA considers factors such as price movements, economic indicators, and market sentiment to establish correlations.

By identifying correlated currency pairs, the EA can potentially predict the direction in which one pair will move based on the movement of another. This correlation-based approach allows the Multi Hedge EA to execute trades with a higher probability of success, taking advantage of predictable price movements.

Hedging Strategy

In addition to its correlation strategy, the Multi Hedge EA employs a hedging technique to manage risk. The hedging strategy involves opening multiple positions in the same direction while simultaneously opening opposing positions. This approach aims to reduce potential losses when adverse price movements occur.

The hedging strategy acts as a safety net, enabling the EA to manage risk by offsetting losses from one trade with gains from another. By hedging, the MultiHedge Robot aims to maintain a balanced portfolio even in volatile market conditions.

Please test in a demo account first for at least a week. Also, please familiarize yourself with and understand how this MultiHedge EA works, then only use it in a real account.

Recommendation for MultiHedge Robot

- Minimum account balance of 100$.

- Trade on USDCAD, USDJPY, and AUDUSD at the same time. You only need to attach it to one chart, and it will trade on all three pairs.

- Work best on M5 and H1 TimeFrames. (Work on any time frame)

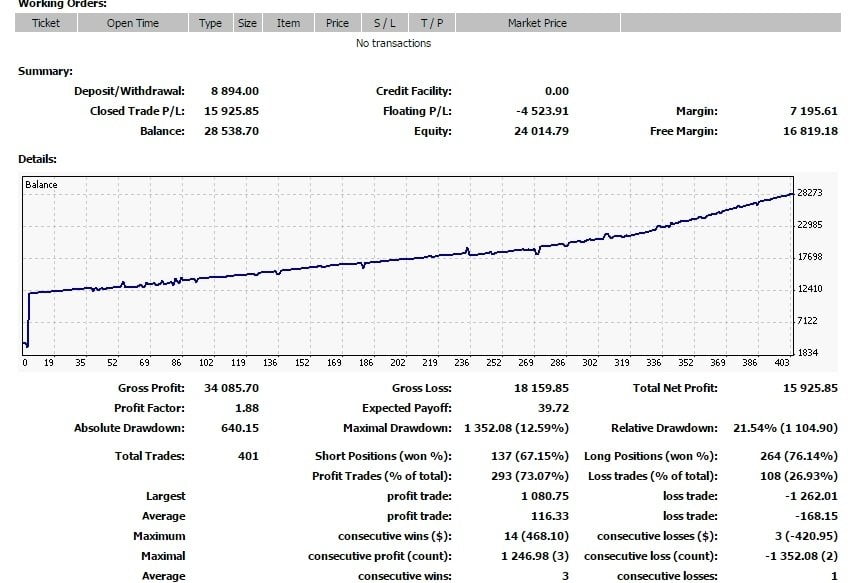

- MT4 cannot perform multi-currency backtests, So when you backtest this EA, you only get the result of the only pair you tested.

- The MultiHedge Robot should work 24/7 on VPS to reach stable results. So we recommend running this free forex EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- The EA is NOT sensitive to spread and slippage. But We advise using a good ECN broker (Find the Perfect Broker For You Here)

Potential Weaknesses

While the Multi Hedge EA offers promising features, it is crucial to acknowledge its potential weaknesses. One key weakness is the inherent unpredictability of currency correlations. Market conditions can change rapidly, altering the relationships between currency pairs and diminishing the reliability of historical correlations. Unexpected events, economic announcements, or geopolitical factors can all disrupt correlations and impact the performance of the EA.

It is vital for traders using the MultiHedge Robot to remain vigilant and adapt their strategies accordingly. Regular monitoring and adjustment of the EA’s parameters are necessary to account for changes in market conditions and ensure optimal performance.

- Read More Silicon Falcon EA FREE Download

Conclusion

The MultiHedge Robot presents an intriguing option for traders seeking to capitalize on correlations and implement hedging strategies in their forex trading endeavors. By leveraging historical correlations between currency pairs and utilizing a hedging technique, the EA aims to generate profits while minimizing potential losses.

However, it is crucial to recognize that the Multi Hedge EA is not immune to market volatility and unexpected events. Traders should exercise caution and continually monitor the performance of the EA to adapt to changing market dynamics.

Awesome hedger. Finally found this one and it works with the settings I figured out. Got 20% yesterday with 2% DD. Challenge passed. Thanks for this.

can you tell what setting you used? Thank you

Please share the settings