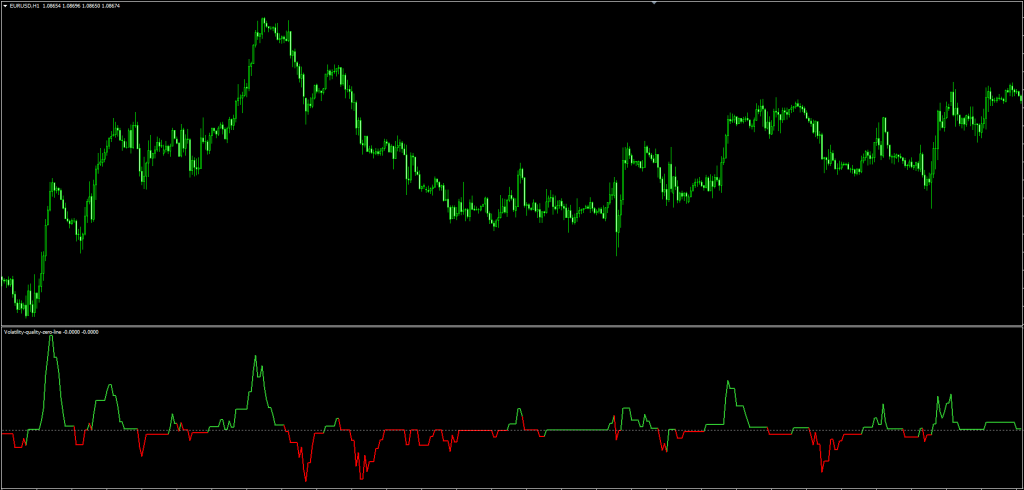

The volatility quality zero line is an ATR (Average True Range) Indicator Free to Download for MT4 and MT5. It is both a trend trading indicator and an indicator for volatility. It suggests the price trend with two colors, red and green. The green line suggests that the market is in an uptrend, while the red line suggests a downtrend. And as for its volatility duties, the farther the line is from the zero line is how much volatility there is in the market.

Volatility Quality Zero Line is a variation of the Volatility quality indicator invented by Thomas Stridsman. But the Volatility quality zero line indicator differs from its source indicator in how less sensitive it is. It does not give as many signals as the source indicator, and as a result, it is more resistant to false breakouts. It uses the Open High Low Close values of a Weighted Moving Average to derive its values. On the downside, however, the market volatility indicator can be slow to react to price movements.

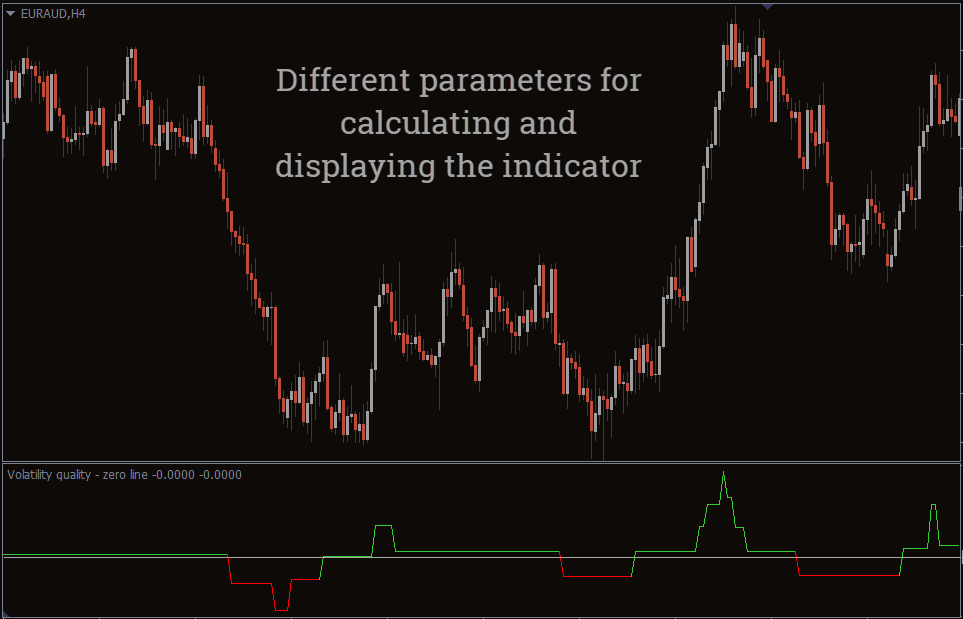

In order to lessen the number of signals (which can be enormous if the VQ is not filtered), some versions similar to this use pips filters. This version of Volatility Quality Zero Line uses % of ATR (Average True Range) instead. The reason for that is that :

- using fixed pips value as a filter will work on one symbol and will not work on another

- changing time frames will render the filter worthless since the ranges of higher time frames are much greater than those at lower time frames, and when you set your filter on a one-time frame and then try it on another, it is almost sure that it will have to be adjusted again

- To avoid this indicator, use ATR % for filtering and which automatically adjusts it to symbols and time frames.

Additionally, this version of Volatility Quality Zero Line is made to oscillate around the zero line (which makes the potential levels, which are even in the original Stridsman’s version doubtful, unnecessary)

The Volatility Quality Zero Line Indicator is a standalone trading indicator, But I recommend additional chart analysis. This indicator can be handy for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, it can be beneficial to practice trading on an MT4/MT5 demo account until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

What is Average True Range

The Average True Range (ATR) is a volatility indicator that measures the average range of an asset’s price movements over a certain period of time. It was developed by J. Welles Wilder Jr. and is commonly used in technical analysis to measure the volatility of a stock, commodity, or currency.

The ATR is calculated by first finding the True Range (TR) of an asset, which is the greatest of the following:

- The difference between the current high and the current low

- The difference between the current high and the previous close

- The difference between the current low and the previous close

The ATR is then found by taking the average of the TR over a certain number of periods, typically 14. The resulting value is typically expressed as a decimal and can be compared to other assets to get a sense of relative volatility.

The ATR is a widely used indicator, and it can be used to help traders identify potential volatility and to help assess the risk of a trade.

Using the Volatility Quality Zero Line Indicator

Trade entries with the Volatility Quality Zero Line indicator is just one part of the equation. The other part is knowing how to set stop losses and take profit with the indicator.

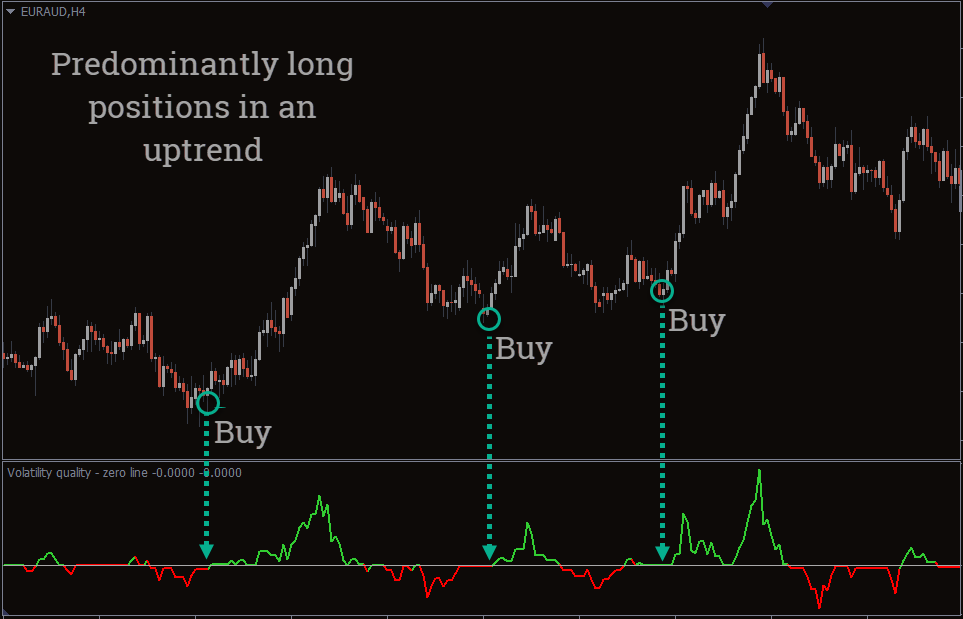

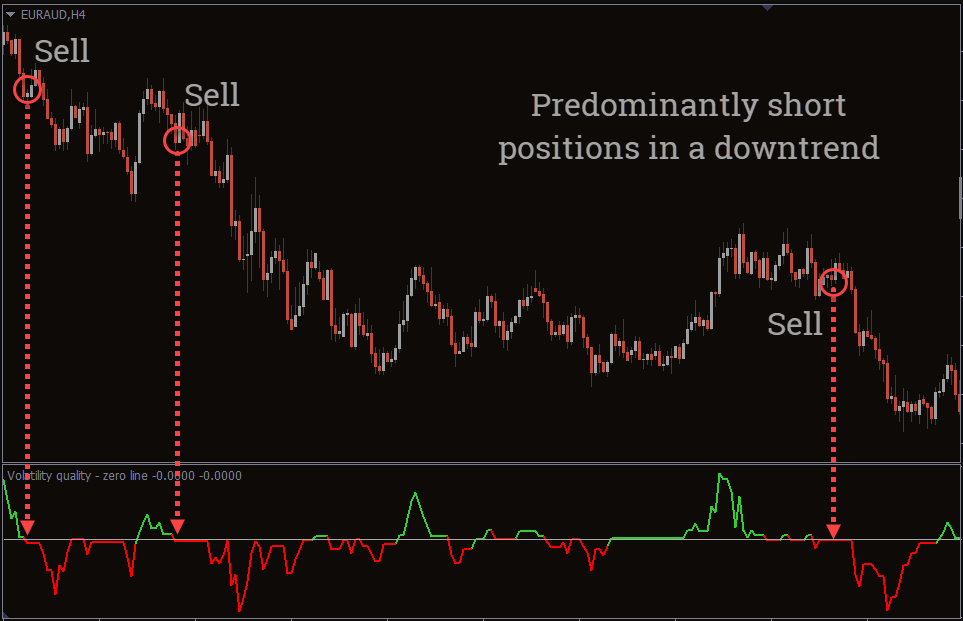

You can use the color change as a signal when using this indicator.

- Buy – The color changes from Red to Green

- Sell – The Color changes from Green to Red

Take profit

To set take profit levels using the indicator, exit trades at the beginning of new signals. For instance, when the volatility trading indicator goes from green to red, exit all long positions. And when the indicator goes from red to green, exit all short positions.

Stop loss

A way to set your stop loss level is to note the most recent high or low before the Volatility quality zero line indicator gives a signal. For instance, note the most recent high after the indicator changes from bullish to bearish and place your stop loss above it. This method is based on the idea that for a downtrend to occur in a financial market, there have to be lower lows and lower highs. And for an uptrend, there have to be higher highs and higher lows.

You can also use this method of setting your stop loss to filter out your trades. If you find that the most recent high or low is too far from where the new signal is, that might be a sign not to take that trade. The reason for this is that the market might have run out of momentum before you get enough pips out of the trade.

Warning! Please read the MetaTrader EA Installation Tutorial if you do not know how to set up this forex expert advisor.