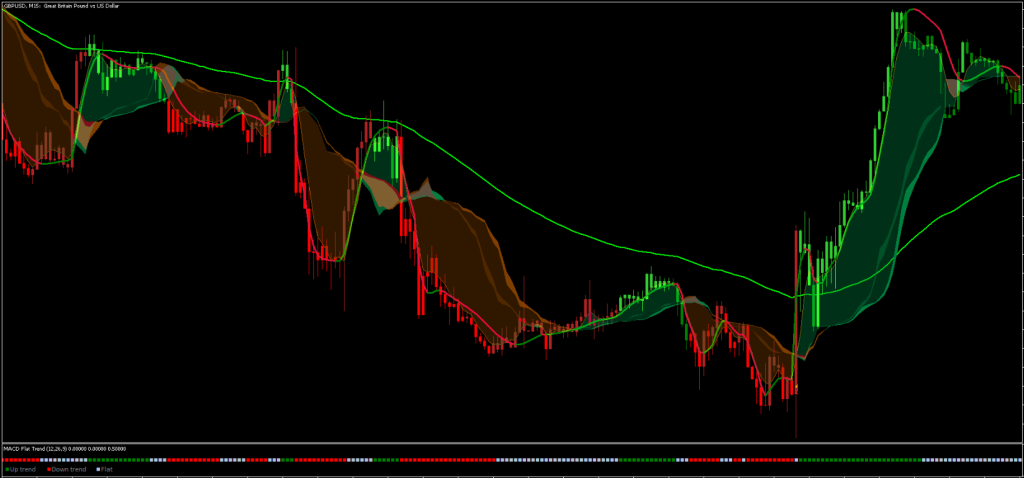

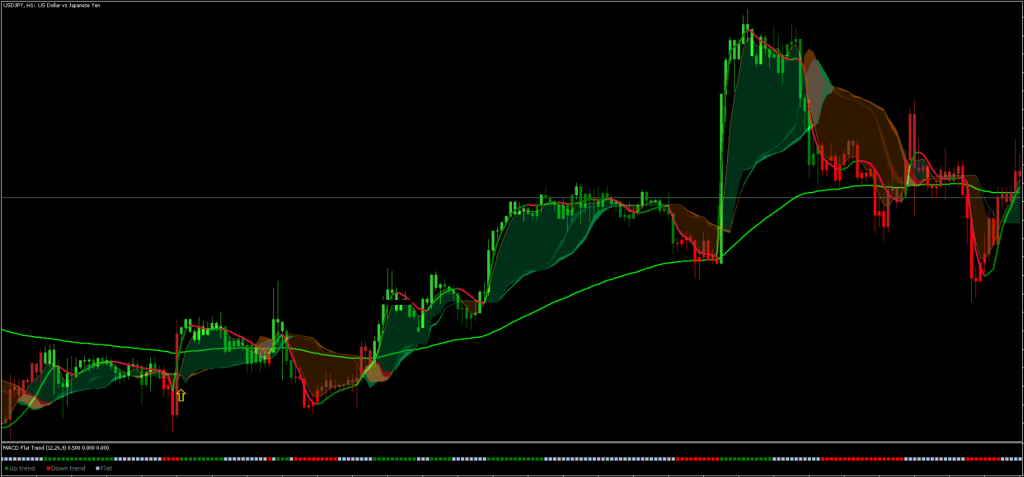

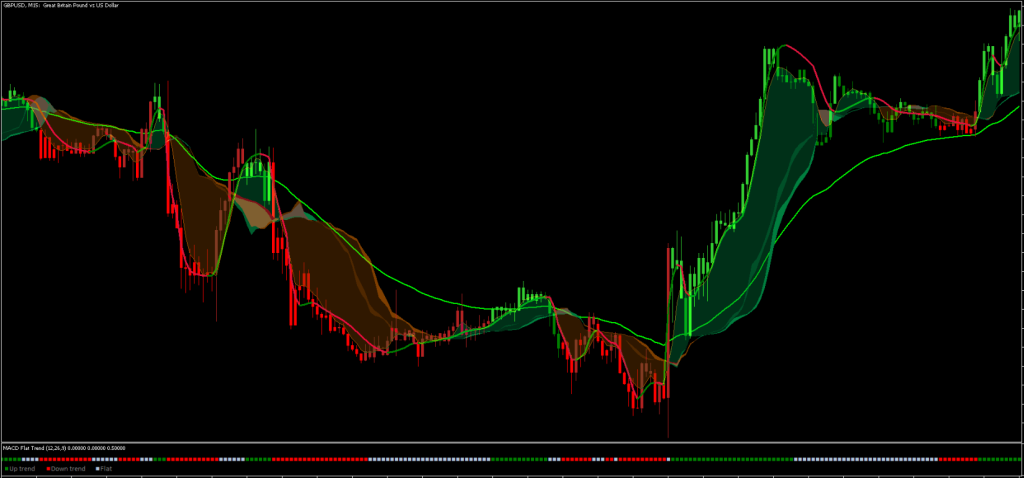

The Easy Trend Visualizer is a trend momentum strategy that is based on the trend indicator MACD flat indicator. This strategy is designed to follow trends and generate signals using the MACD flat indicator as a filter or entry point for trend following strategies. The result is a simple, yet robust trend following strategy that can be used by traders of all levels.

The strategy is very simple to use. You simply follow the trend and the signals are generated by the MACD flat indicator. The proposed version of MACD flat is an excellent filter or entry point for trend following strategies. This is because it is a reliable indicator that can help traders identify trends and momentum in the market.

To use the Easy Trend Visualizer strategy, you will need to have access to a few key Metatrader 5 indicators. These include the Exponential Moving Average 100, Trend Detector, JMA green line, Trend Bar, and MACD Flat. Once you have these indicators set up, you can begin using the strategy to identify trends and generate signals.

The Exponential Moving Average 100 is used to help identify the overall trend in the market. This Trend Momentum Strategy indicator System is a reliable way to determine whether the market is in an uptrend or a downtrend. The Trend Detector is used to help identify trends and momentum in the market. This indicator is a reliable way to determine whether the market is trending or not.

The JMA green line is used to help identify the strength of the trend. This indicator is a reliable way to determine whether the trend is strong or weak. The Trend Bar is used to help identify the current trend direction. This indicator is a reliable way to determine whether the market is currently in an uptrend or a downtrend.

Finally, the MACD Flat indicator is used to generate signals. This indicator is a reliable way to determine when to enter and exit trades. When the MACD Flat line crosses above the zero line, it is a signal to enter a long trade. When the MACD Flat line crosses below the zero line, it is a signal to enter a short trade.

In conclusion, the Easy Trend Visualizer MT5 is a simple yet robust trend momentum strategy that can be used by traders of all levels. By following the trend and using the MACD Flat indicator as a filter or entry point, traders can identify trends and generate signals that can lead to profitable trades. So if you are looking for a reliable trend following strategy, give the Easy Trend Visualizer a try.

The Trend Momentum Strategy is a standalone trading indicator, But I recommend additional chart analysis. This indicator can be handy for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, it can be beneficial to practice trading on an MT5 demo account until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

What is Trend Momentum

Trend momentum refers to the strength and speed of the current market trend. It is a technical analysis tool used by traders and investors to determine the direction and potential magnitude of price movements in a given market.

Momentum is calculated by measuring the rate of change of an asset’s price over a certain time period. If the price is rising at an accelerating rate, this indicates a bullish momentum, while a decreasing rate of change may signal a bearish momentum.

Trend momentum is often used in conjunction with other technical indicators to confirm or validate a market trend. For example, traders may use moving averages or oscillators to confirm the direction and strength of trend momentum.

How it used in Forex Strategies

Trend momentum is a commonly used tool in forex trading strategies. Forex traders use trend momentum to identify the direction and strength of the market trend, which helps them make informed trading decisions.

Here are a few ways that forex traders use trend momentum in their trading strategies:

- Trend Following: Many forex traders use trend momentum to identify the direction of the market trend and then enter trades in the direction of that trend. This strategy involves buying an asset when its price is trending upwards and selling it when the price starts to trend downwards.

- Breakout Trading: Another popular forex strategy is breakout trading, which involves entering trades when the price breaks through a key level of support or resistance. Traders can use trend momentum indicators to confirm the breakout and identify potential entry and exit points.

- Oscillator Analysis: Oscillators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), are commonly used alongside trend momentum indicators to confirm the strength and direction of the trend.

Overall, trend momentum is a valuable tool for forex traders as it helps them identify the direction and strength of the market trend, which is critical for making profitable trading decisions.

Trend Momentum Strategy Trading rules

Follow money management & Don’t enter to trade within the Medium or high-impact news period.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

Buy signal or Call

- MACD green square.

- Green candle.

- Ribbon below the candles (trend detectror).

- JMA Indicator Line green.

Sell signal or Put

- MACD red square.

- Red or maroon candle.

- Ribbon above the candles (trend detectror).

- JMA Indicator Line Red.

Exit position for Trend Visualizer MT5

Any positions with Trend Momentum Strategy can be liquidated using a fixed profit target. Alternatively, the profit target should be set using previous support/resistance or high/low as a reference point. You may also exit the trade manually if the Non-Repainting Indicator system conditions reverse.

- Place initial stop loss below/above the previous swing high/low

- Make profit ratio stop loss 1:1.12, or when Robbon (trend detector changes direction).

It is recommended to use a stop loss. Set SL below the entry price using previous support/resistance as a reference point Or on the last high/low swing. Using fixed stop loss settings without any reference points is not advocated.

Warning! Please read the MetaTrader EA Installation Tutorial if you do not know how to set up this forex expert advisor.

[…] calculations of the Price Volume Trend mt5 forex indicator are based on the below […]