Carry Forex Trade strategy is one of the most popular fundamental Forex trading strategies. It is used not only by familiar retail traders but also by significant hedge funds. The main principle of the carry forex trade strategy is to buy currency with a high-interest rate and sell one with a low-interest rate. The such setup offers profit not only from the currency pair’s fluctuations but also from the interest rate difference (overnight interest rate). Should only apply This strategy under normal global economic conditions. It would be best if you never used it during the crisis. Remember that your MT4 Forex broker should be one of those that pay overnight interest rate difference if you want to gain from it. You will not be able to gain from it if your broker is “swap-free.”

Carry Forex Trade Strategy Features

- Long-term profit potential.

- Two sources of profit.

- Works only with the growing global economy.

How to Trade?

- Choose a currency pair with a high positive interest rate difference (AUD/JPY, GBP/JPY, and NZD/JPY are good historical examples of such pairs).

- Go Long or Short Sell on the chosen pair, depending on the direction with the positive overnight interest rate for this pair.

- Choose a moderate position size so that it would be able to withstand a significant paper loss.

- Do not set a stop-loss(SL) (one of the few Forex trading strategies where stop-loss is not recommended).

- Wait.

- Close the position when you feel you earned enough or expect some global financial turmoil.

Example

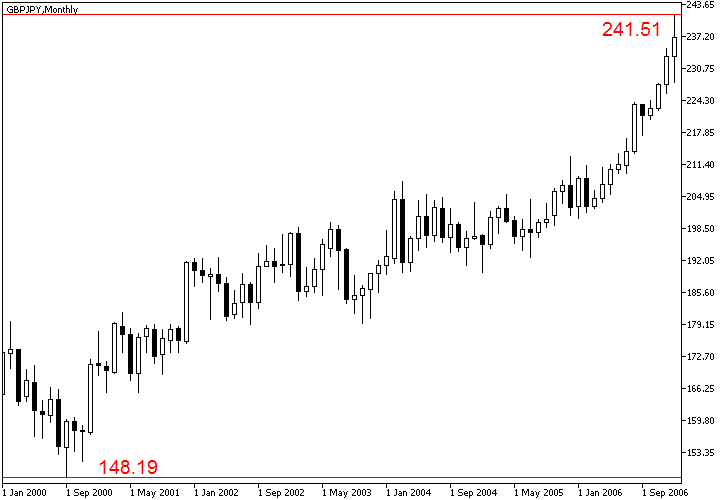

The example chart depicts a long-term “carry trade” growth of the GBP/JPY pair from late 2000 to early 2007. The pound(GBP) had an interest rate of about 5% during the period, while the yen(JPY) had its rate near 0, resulting in an overnight rate of about 5%, which is then multiplied by your account leverage. With 1:100, account leverage is approximately 3,000% over the whole period. The GBP/JPY pair also rose by more than 9,300 pips during the period. As you can see, the profit potential is simply outstanding.

The problem is that the market uptrend ended very fast in 2007, and forex traders had little time to react and close their open positions. The carry trade is quite risky, and you should be careful when using it.

Warning!

Use this strategy at your own risk. fxcracked.com cannot be responsible for any losses associated with using any strategy presented on the site. Using this strategy on the real account is not recommended without testing it on the demo first.

Discussion

Do you have any other suggestions or questions regarding this strategy? You can always discuss Carry forex Trade Strategy with your fellow Forex traders on the Trading Indicators and Strategies forum.