Your charts are your best friends if you’re an investor or trader. They provide insights into the markets and help you pick winners. And when it comes to charts, TradingView is one of the foremost providers. But for beginners, the platform can seem overwhelming at first. Don’t worry, though—we’ve got you covered!

In this article, we’ll walk you through everything you need to know about getting started with TradingView charts. We’ll cover the basics—like getting set up and chart types—and more advanced features, such as indicators and custom settings. You’ll be mastering those charts in no time! So, let’s dive in and explore the world of TradingView.

What Is TradingView?

TradingView is a powerful online charting platform that makes it easy for traders to track markets, analyze trends, and build powerful strategies. It provides an array of real-time data, technical analysis tools, and advanced charting capabilities and allows you to monitor multiple markets in the same place.

Using TradingView charts, you can make informed decisions by studying the historical shifts in price movements – all while staying up-to-date with the latest market news. It also offers advanced risk management tools that help you better manage your trading positions and portfolio. In addition, it offers many technical analysis tools, such as indicators and drawing tools. Whether you’re a beginner or a pro trader, TradingView offers something for everyone.

What Are Trading Charts?

Trading charts are the cornerstone of technical analysis for traders. These interactive charts allow you to visualize market movements and make more informed investment decisions. TradingView charts are a powerful tool that can be used for stock and cryptocurrency trading, as well as other financial markets.

What makes TradingView charts so special? Firstly, they come with various features that allow you to customize and analyze the data. You can add indicators, overlays, ratio drawings, drawings, and text annotations in one chart. Secondly, they provide an easy-to-use platform with interactive tools that allow you to quickly display patterns and identify trends. Finally, you can access live market data with real-time quotes or build a custom portfolio dashboard with watchlists and alerts.

In short, TradingView charts provide a comprehensive toolkit for traders looking to make smarter decisions in the markets. With TradingView charts, traders can quickly analyze data and find opportunities in any market.

What Types of Trading Charts Are Available on TradingView

Using TradingView charts, you can customize your charting experience and make decisions based on live market data. Depending on your trading preferences, you can choose from various chart types and customize them for a better market view.

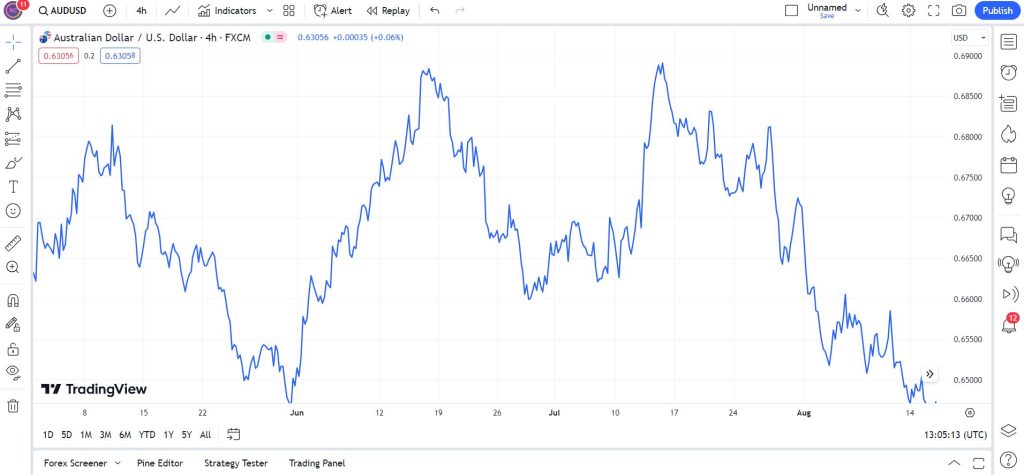

Line Charts

A line chart is the simplest type of chart you can use on TradingView. It draws straight lines between price points and does not consider other data. Line charts are used to observe a particular asset’s general direction of movement over a specific period.

Bar Charts

Bar Charts, known as OHLC (open-high-low-close) charts, provide traders with more detailed information than line charts. In addition to showing open and close prices, Bar Charts also show the high and low prices for each period. They are especially useful in tracking drastic changes in price over time, such as those seen during big news events or dips in the market.

Candlestick Charts

Candlestick Charts are almost identical to bar charts, with one big difference. Instead of plotting open and close prices as horizontal lines, they use a combination of vertical lines and filled boxes called “candles,” representing different trading periods within an asset’s price action. The candle’s body denotes the open/close price range, while the upper/lower shadows indicate the highest/lowest values during that period. Candlestick Charts are especially useful for traders spotting possible price reversals or breakouts from support/resistance levels in combination with technical analysis indicators like MACD or RSI.

These are just a few charts available on TradingView, so take some time to experiment and find the one that works best for you!

How to Create a TradingView Chart

Now that you know the basics, let’s dive in and learn how to create a TradingView chart.

Choose your assets

The first step when creating your TradingView chart is to choose the assets you want to trade. You can customize your chart with stocks, forex, indices, or cryptocurrencies. You can add multiple assets to your chart by adding them all at once or clicking on the “+” symbol in the top right-hand corner.

Set up your Chart Template

The next step is to set up your chart template. This includes setting up:

- Your time frame, which determines the detail of the data in the chart

- Your indicators and overlays help you analyze specific data and trends more quickly.

- Your drawing tools and drawing settings, like drawing straight lines or linear regression channels

- Your color scheme and theme—which you can change from dark mode to light mode if needed—and text labels for visual reference

Once you’ve made all your changes to your Chart Template, click “Save Template” for easy access next time!

How to Read and Interpret Trading Charts on TradingView

Interpreting trading charts on TradingView can be daunting initially, but it doesn’t have to be. Once you know the basics, you’ll read trading charts like a pro.

Charts

Charts are visual representations of data, allowing you to see the price action of a stock or currency pair over time. These chart patterns provide valuable insight into future price movements, helping you make more informed trading decisions.

Timeframes

TradingView charts can be viewed in different timeframes—from one minute to one month — giving you the flexibility to view short-term or long-term price movements. Your chosen timeframe will determine how much detail you’ll see in your chart.

Indicators

TradingView gives you access to various indicators that can help you identify trends and pattern development. Popular indicators like moving averages, Relative Strength Index (RSI), Bollinger Bands, and MACD are available on TradingView charts. You can customize these indicators to suit your individual trading needs and preferences.

Once you know how to read and interpret TradingView charts, you can confidently make more informed trading decisions!

Analyzing Historic Data With TradingView

If you’re looking to analyze historical data, TradingView has you covered there too. Now that we’ve gone through the basics of navigating and customizing TradingView charts let’s look at how you can use them to analyze historical data.

Understand market trends

Whether you’re trading stocks or crypto, it’s essential to understand the current market trend to determine where the market might be headed. TradingView makes it easy to spot long-term trends with its ability to span periods of days, weeks, months, or even years. You can switch between different time frames with a few clicks and investigate further by zooming into specific areas of interest.

Identify patterns

Market patterns are another way of spotting potential new trades — and TradingView has a feature for that, too. Plotting past price movements for specific assets on a chart can help you identify any reoccurring patterns in the market based on highs and lows from days gone by. For example, if an asset has risen significantly after breaking through a certain price in the past, it will likely do so again.

TradingView also allows you to draw trend lines on your chart and use indicators like Fibonacci and Elliott waves to help you make better-informed trading decisions about specific assets. The more practice you get in analyzing historical data with TradingView tools will give your trades an extra edge — so why not give it a go?

Read More Auto Candlestick Patterns Detector TradingView Script For FREE

Analysis Tools and Indicators

TradingView comes loaded with various tools and indicators for completing the technical analysis. To give you an idea, you can use features like:

Chart Types

Choose from over 50 chart types, including bar, line, bars, and hollow candles, to get the right visual representation of your data. Don’t forget that TradingView also has its unique chart type – the Heikin-Ashi chart – which is especially useful for day traders.

Drawing Tools

Use drawing tools when analyzing price movements to analyze trends by overlaying trend lines, Fibonacci retracements, shapes, and many more. You’ll be able to do all of this in 3D as well.

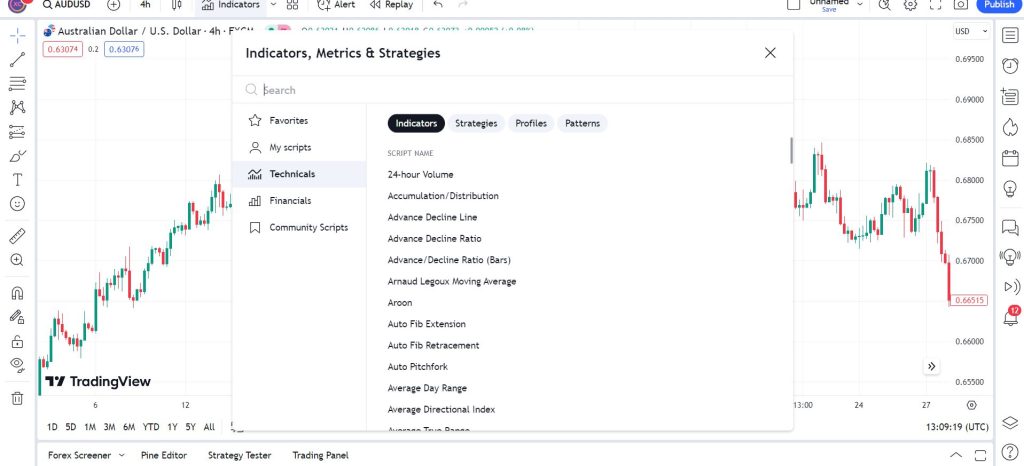

Indicators

There are over 150 indicators available on TradingView! Some of these commonly used include:

- Moving Averages (MAs)

- Relative Strength Index (RSI)

- Stochastics

- Bollinger Bands (BB)

Each indicator can be customized by changing style and color to suit your trading style preference.

These analysis tools simplify identifying potential entry and exit points on a chart quickly and easily. With TradingView charts, you’ll have a clear overview of where trading markets have been and where they might be going next.

Understand the Technical Indicators Used in TradingView

If you want to get serious about using TradingView charts to inform your trading decisions, you will need to understand the technical analysis tools it provides. First, let’s take a look at some of the indicators that are available on TradingView.

Volume Indicators

The volume indicators on TradingView tell you how much of an asset is being traded over time. The most commonly used indicator is the volume bar chart, which shows how many shares or contracts have been traded during a certain amount of time. Other volume indicators include the Chaikin Money Flow (CMF) and On-Balance-Volume (OBV).

Momentum Indicators

Momentum indicators measure the speed and magnitude of price changes over a certain period of time. These include the Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD).

Overlays

Overlays compare an asset’s performance with another asset or an index. Some popular overlays include Bollinger Bands, Moving Averages, and Fibonacci Retracements.

Oscillators

Oscillators identify reversal points in price action that highlight potential buying or selling opportunities. Common oscillators include RSI, Stochastics, and Williams %R.

These indicators can be overlaid onto TradingView’s charts to analyze trends and make more accurate trading decisions without leaving the platform!

Tips for Making Better Trading Decisions With TradingView

Sometimes, it can be hard to make trading decisions without getting a better understanding of what’s going on. TradingView charts can be a great tool for helping make informed decisions.

Here are some tips to help get the most out of TradingView:

- Be sure to research market news so that you have an idea of your asset’s short-term and long-term outlook.

- Look at technical indicators such as the Moving Average Convergence/Divergence (MACD), showing how a stock has moved over time.

- Analyze price patterns such as wedges or triangles that form patterns in the market that can be used to your advantage when trading.

- Use chart overlays such as Bollinger bands, Fibonacci retracement, and Ichimoku clouds to get additional insights into the market.

- Utilize trend lines and support/resistance levels to find areas where the price may reverse or further extend its move up or down.

- Set up alerts on specific stocks so you know when they cross key levels or experience high volatility – allowing you to take advantage of opportunities quickly and efficiently!

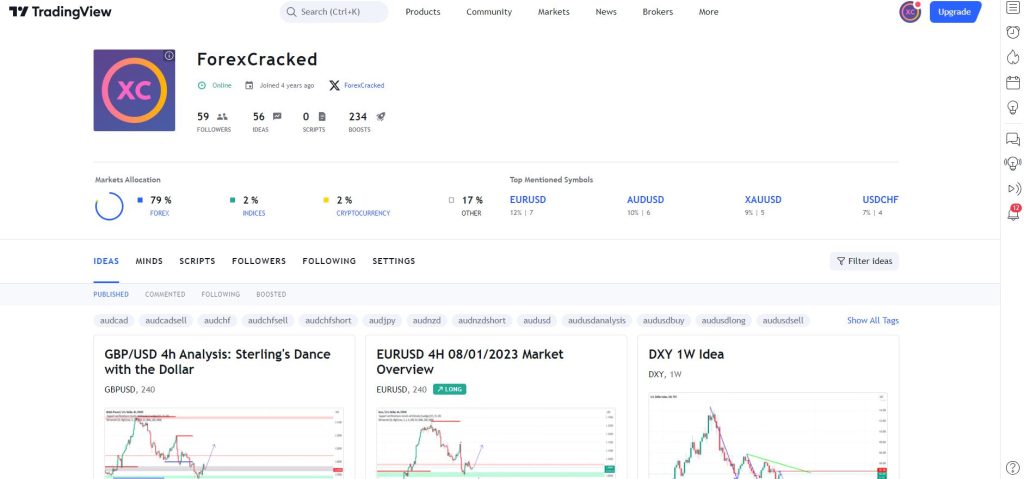

Sharing Your Chart and Findings With Others

Finally, remember that you can always share your charts with others on TradingView. Whether you want to share your chart setup or the results of your trading experiment with a friend, this is a great way to do it.

Here’s how you can share your charts and findings:

- Click the Share button at the top right of the chart.

- A box will appear, which includes a web link and a QR code for sharing the chart view on social media or via email or chat apps.

- You can also share screenshots of your charts with annotations from the Chart Tools menu at the top left of the screen, which will let you highlight specific areas in more detail.

- You can also export data tables, such as those found in an indicator window, by clicking Export in the relevant window menu bar and selecting either CSV or XLS format for downloading (check out their support page for more).

- Lastly, don’t forget that you can permanently save any setup you create—this way, it will be available whenever you return to TradingView!

Conclusion

TradingView charts can be an invaluable tool for any trader, providing essential data and information that can significantly enhance your trading decisions. With the ability to customize the charts and add indicators or alerts, you’ll be well on your way to mastering the art of trading.

As with any tool, the more you use it, the better you’ll become at mastering it. With TradingView, gaining a firm understanding of the platform’s features, tools, and functions can be done relatively quickly, allowing you to get the most out of your investments and trades. Start trading smarter today with TradingView charts!