The Camarilla indicator for MetaTrader 4 helps calculate the daily pivot point along with support and resistance levels. This indicator’s support and resistance levels go up to the fifth.

This is accomplished by using the previous day’s Low, High, Open, and Closed and using the chart data to calculate the ten levels, of which five are the low chart support level and five others are the five chart resistance levels.

However, the most significant of all these chart levels are the L3 and L4.

The pivot point is obtained using the Camarilla Equation, hence the Camarilla pivot points. These pivot lines help perform intra-day trading. Therefore this indicator is best for forex short-term traders and forex scalpers.

Trading using the camarilla indicator

As a forex trader, you should always look at the L3 and L4 levels since these are the points to enter your orders. So when the forex market gets to the L3 level, you should open buy and sell orders when the market price levels hit the H3 class.

You have to wait and confirm before putting any trade position. The L3 is a chart resistance level, while the H3 is a chart support level. At the resistance and chart support levels, the market prices are to reverse or bounce back. However, sometimes, these reversals may be too short-lived that they may not lead to any profits. So as a forex trader, you should be advised not to open forex trades immediately when the prices hit these levels. It would be best if you held your peace until you have seen the market take on a reversal. This may be shown by the formation of exhaustion or chart pin bar candles, exhaustion gaps, or break-away gaps at these levels.

When trading in the chart region between the L3, H3, and the chart breakout levels, once you have opened a forex trade position, then ensure that you target small, realistic profits. Can do this by placing take profits at a distance that is not too far from the opened position. The camarilla indicator doesn’t show long-term trends. It only indicates short-term trends. Therefore, to benefit from these, you have to be ready to take small forex profits and get out of the forex market as soon as possible. Failure to do this you will end up making consecutive losses.

However, when the chart breakout level is hit, then you can be assured of an actual trend in the market prices. The chart breakout levels are at the L4 and H4. If these levels are hit, you can expect the prices to continue in the direction they have chosen. That means if the L4 is passed, there is a downward trend and a chart uptrend when the chart H4 is gone past. This means you can buy entry when prices rise above the chart H4 and sell when chart prices fall below the L4 level. Then you can target good profits at the L5 and H5 levels, respectively.

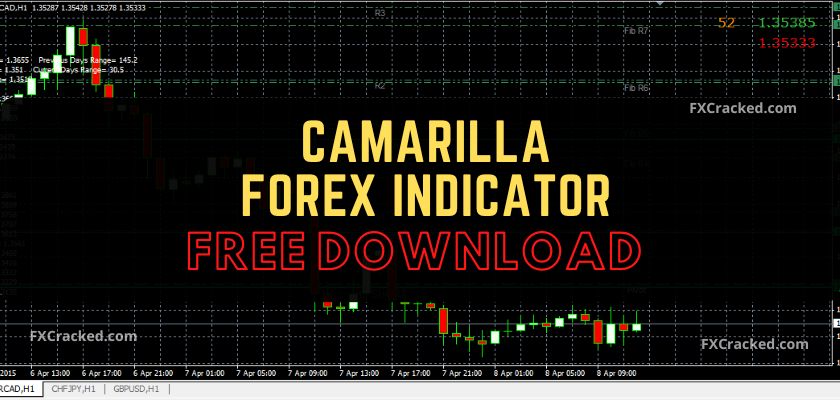

Fig.1.using the camarilla forex indicator.

From the above mt4 figure, it is not possible to view the chart L3 and the L4 levels. However, if the chart is compressed, it can be visible. But if you check at the left side of the mt4 chart, the position of all the levels is indicated.

Read More Breakout Panca Eagle Forex Indicator Free Download

Camarilla Forex Indicator Free Download

Thanks Admin.