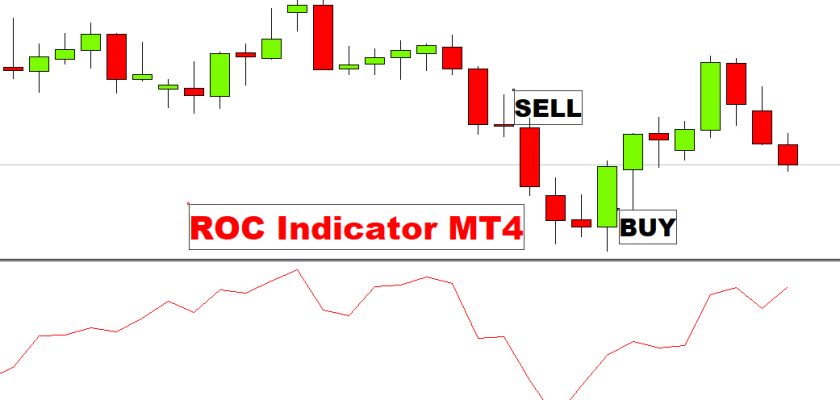

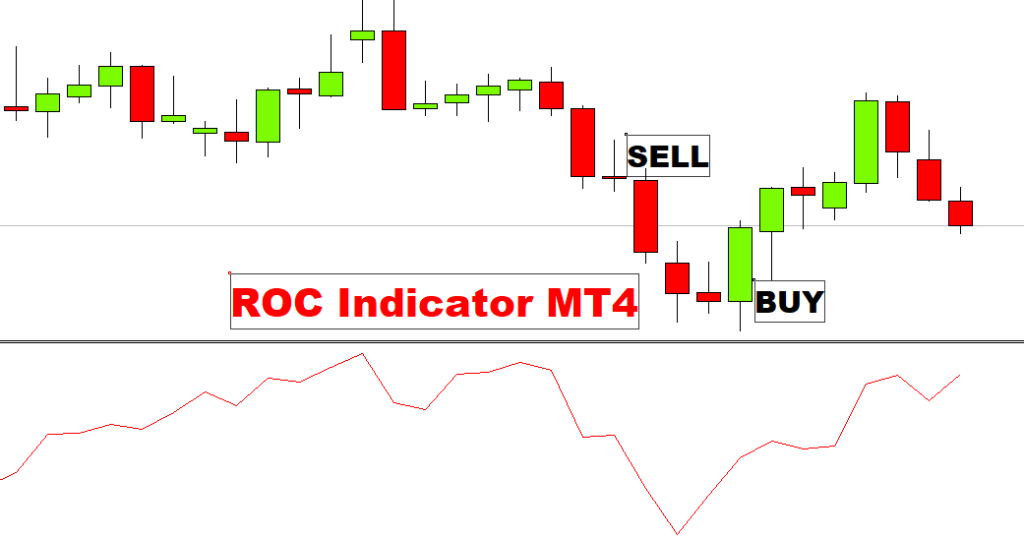

The Rate of Change ROC forex indicator for MT4 calculates the rate of price change between the current closing price and the closing price before “n” periods. The forex indicator generates Bullish and Bearish chart trend change signals, which forex traders can use to place BUY entries or SELL trades.

How does the ROC Indicator work?

The ROC indicator generates forex signals based on divergence and convergence. Furthermore, based on the forex oscillator’s overbought and oversold conditions, forex traders can predict chart reversals and exit early.

This forex indicator reflects price momentum and assists traders in interpreting oscillator values and trading signals in various ways. As a result, the forex indicator is extremely useful for new forex traders in identifying entry and exit points.

However, advanced forex traders can use convergence and forex divergence techniques and plot forex support and resistance on the forex indicator to trade complex technical forex trading strategies. Because the forex indicator lacks an upper and lower value limit, advanced traders must exercise caution when using oversold and overbought conditions. Furthermore, the forex indicator is free to download and simple to install.

Trading with ROC Forex Indicator MT4

Method 1

Buying

The forex indicator’s zero-line crossover is the primary method for detecting trading entry signals. If the oscillator crosses the zero line from down to up, the chart price trend is BULLISH.

Forex traders can enter a BUY entry position with a stop loss(SL) lower than the previous chart swing low. The best profit-taking forex strategy is to follow the oscillator indicator and stay long as long as the indicator is above the zero line.

See also FXSTABILIZER PRO MT4 Forex EA FREE Download

Selling

If the forex oscillator falls below zero, it indicates a BEARISH trend. Traders can place a SELL entry order with a stop loss (SL)above the previous swing high.

If the oscillator indicator rises sharply above the zero line, this indicates a strong BULLISH chart trend; conversely, a sharp drop below the zero line indicates a stronger BEARISH market trend.

Method 2

The next critical step is to identify price and forex indicator divergence and convergence. forex Divergence or convergence reveals that the values of the ROC forex indicator and the price do not agree. Therefore, forex traders can buy entry and sell by the BULLISH or BEARISH divergence forex trading strategies.

Method 3

The third approach involves plotting Forex Support and Resistance, which are the cornerstones of technical analysis. Forex traders can use this forex indicator to draw channels and forex support and resistance lines. Technical forex traders can trade breakouts when they coincide with price movement.

Conclusions

The ROC forex indicator for MT4 allows you to trade the trading entry signals in several ways. However, forex traders should exercise caution when using the indicator’s forex trading entry signals. Only the closing price’s rate of change is used in the calculations. As a result, there is some lag in both the bullish and bearish forex trading signals. To trade with confluence and other technical forex indicators, forex traders should do so.